One of my biggest passions is seeing as much of the world as I can, but it would be a lot more expensive without travel credit cards and other travel hacks. I have three travel credit cards all with varying annual fees. Here are the benefits of each one so you can decide which one is right for you:

BILT Mastercard

Annual fee: $0

If you pay rent and you don’t have this card you’re missing out! With no annual fee, there is no reason to not have this card in your wallet. Rent is typically one’s most expensive purchase each month, and this card allows you to get 1x points on rent so you can use those points for travel. Once approved, you’ll receive a personal bank and routing number so you can pay rent through a portal, with Venmo, or even with a check without having to pay a transaction fee. Just make sure you use this card for five transactions monthly to receive the points you’ve earned. This card also allows you to earn points when buying a home and provides resources in their BILT app to help with purchasing a home. Besides there being no annual fee and being able to earn points on rent (up to 100,00 points per year) and a down-payment for a house, there are even more amazing benefits to this card including:

- 2x points on travel

- 3x points on dining

- 1x points on everyday purchases

- 5x points on Lyft rides

- 2x+ points on Walgreens purchases

- Rent Day Bonus Points: 2x points on the 1st of every month

- 6x on dining

- 4x on travel

- 2x on other purchases

- Monthly Family Feud-style game where winners get free rent for each month

- Monthly $5 Lyft credits

- No Foreign Transaction Fees

- Limited travel and car rental insurance

- Other neighbourhood benefits such as savings on fitness classes an extra points on specific restaurants

- Status change based on how much you spend annually

And that’s just some of the primary benefits to the BILT Mastercard. Get more info, check out the full list of benefits, and sign up with my referral link here!

Disclaimer: I have never used the travel or car rental insurance with this card, and I assume it is limited much like the card below.

Chase Sapphire Preferred

Annual Fee: $95

This was my first travel credit card, and it’s a great introductory card for avid travellers. This card has many similar benefits to the BILT Mastercard with some differing perks. 100 Chase points typically equals $1.25 when using the points in the Chase portal. Here are some of the incredible benefits offered with the Chase Sapphire Preferred card:

- 60,000 bonus points after spending $4,000 using this card in the first three months

- 2x points on travel; 5x points on travel when purchased through the Chase portal

- 3x points on dining

- 5x points on Lyft through March 25, 2025

- If you have both the Chase Sapphire Preferred and BILT Mastercard you can get 7x points on Lyft by having both cards registered on your Lyft app and using the Chase card to pay

- 1x points on everyday purchases

- $50 annual hotel credit through the Chase portal

- Free Doordash Dashpass membership

- $10 monthly credit on non-restaurant Doordash orders

- No foreign transaction fees

- Limited travel and car rental insurance

- 10% anniversary points boost

These are just a few of my favourite benefits you get with the Chase Sapphire Preferred. Get more info, check out the full list of benefits, and sign up with my referral link here!

Disclaimer: I do believe there are some downsides to this card.

- I tend to book budget flights, and there have been quite a few times where the budget flight I want to purchase is not available in the Chase portal.

- I also tried to use the travel insurance last year due to a family emergency affecting my travel plans, and I did not find the Chase customer service line to be very helpful. On top of that, they never gave me my refund on this ticket.

- I also had a friend who had a flight cancellation due to weather, and the travel insurance would not provide them with a refund either.

So please keep in mind that the travel and car rental insurance for this card is pretty limited, but there are still many amazing benefits to this card.

Capital One Venture X

Annual fee: $395

I just opened this card last year, and it is hands down my favorite credit card I own. I know $395 sounds like a lot for an annual fee but the benefits easily outweigh this price with these two perks alone: $300 annual travel credit and 10,000 annual points to be used in the Capital One portal. These two benefits equal $400 in travel. If you’re someone who already spends more than $395 on annual travel anyway, then technically the annual fee you’re paying will be going directly towards your flight, hotel, or rental car bookings. Here’s a list of the amazing benefits that come along with this card:

- 75,000 bonus points after spending $4,000 on this card in the first three months

- 2x points on every purchase

- 5x points on flights through the Capital One portal

- 10x points on hotels and rental cars through the Capital One portal

- $300 annual credit to use on flights, hotels, and rental cars through the Capital One portal

- Automatic refund via credit if your flight’s price decreases within 10 days of purchasing through the Capital One Portal

- 10,000 annual points added to your account

- Hertz Presidents Circle Status

- Free Priority Pass Membership

- This is my favorite benefit of this card! Being able to go into airport lounges before catching my flight is a game changer. Most of the lounges have free food, drinks (both alcohol and non-alcohol), wifi, air conditioning, and comfortable seating. Some even have showers and dark rooms for sleeping. Say goodbye to having to overspend on food and drinks at the airport!

- $120 credit to be used for Global Entry application

- Global Entry also gives you access to TSA Precheck

- No foreign transactions fees

- Cell phone protection

- Up to $800 if your phone is stolen or damaged if you use this card to pay your cell phone bill

- Points don’t expire and there’s no blackout dates

- They will price match if you find the same flight for a cheaper price. You just have to give them a call.

Once again, these are just a few of my favourite benefits of the Capital One Venture X card. Get more info, check out the full list of benefits, and sign up with my referral link here!

Point Transfer Partners

Now that you have a rundown of my three travel credit cards, it’s time to get into how you can maximize on the points you’ve earned by using point transfer partners.

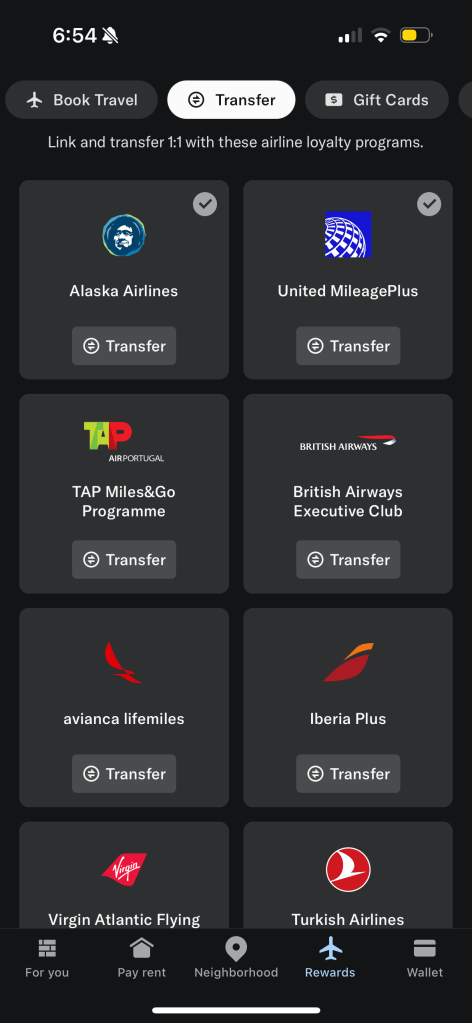

Each credit card has different transfer partners, and sometimes the transfer partners issue point bonuses where you can make 20% or more points just by transferring them over from your credit card app to the airline or hotel company.

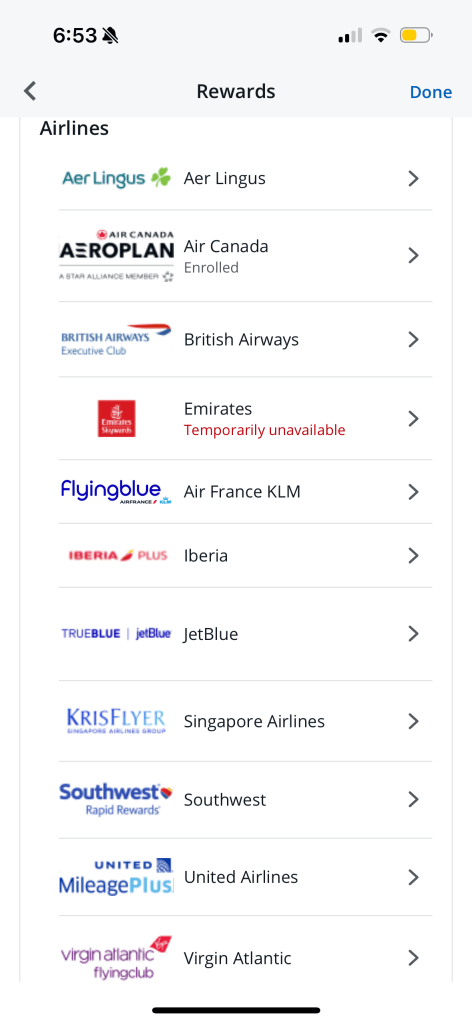

To see which transfer partners are offered simply open your desired credit card app (such as Capital One, Chase, BILT, etc.), click on your earned points or “Travel,” and then you should see an option that says something like “Transfer Partners.” There you should be able to see which transfer partners are offered and if they are offering any bonus points. Here’s what they look like on the three apps I’ve discussed:

Typically all transfer partners will offer a 1:1 ratio, but every once in a while there is a transfer bonus. This is how I recently got my first class tickets from San Juan (SJU) to San Jose (SJO):

- I wasn’t sure when I wanted to fly to San Jose so I ended up booking this ticket four days in advance. Sometimes waiting last minute to book is the key to getting these deals.

- I found the flight I wanted to book using Google flights. It was. Copa airlines flight, which is owned by Star Alliance. The flight was $304, which was a little pricey to go such a short distance.

- There happened to be a 20% bonus offer where transferring Chase points over to Air Canada, which is also owned by Star Alliance.

- Before transferring over the points I made sure the Copa flight I wanted was offered on the Air Canada website. When doing this I noticed that the first class option would be 20,000 + $51, which is cheaper than the economy class ticket for $304.

- I used the Chase app to transfer 16,000 points with a 20% bonus for a total of 20,000 Air Canada points and bought the first class tickets!

I always saw so many people online talking about using transfer partners for buying flights like this, and it always confused me. Once I finally did it, it was so easy!

Here is a TikTok that explains how to do this with a hotel as well. It’s always best to transfer your points directly to the airline or hotel company instead of using your points in the travel portal because that is how you maximize the points you’ve earned.

Other Apps That Help Me Save or Make Money Easily

Fetch is an app that lets you earn points for gift cards by taking photos of receipts and playing games on your phone. There’s so many gift card options such as AirBNB, Delta, restaurants, and grocery stores, so there is bound to be a gift card for everyone. Click here to use my referral link to download the app to your phone. Once you scan your first receipt we both get some free points!

Ibotta is another app that allows you to take photos of receipts in exchange for cash back. Once you get $20 cash in the app you can transfer the money to you bank account. Click here to use my referral link to download the app to your phone and earn $5! Use code: xyxgajd

Gas Buddy is a tool to find the cheapest gas near you. I always use this when I’m driving across the country to make sure I’m not spending unnecessary money on gas. I always like to check before crossing state borders as well to see which state has cheaper gas.

Expedia is the website I typically use to find lodging while traveling. Making an Expedia account is free, and when I use Expedia to book housing then I earn OneKey cash, which can be used for discounts on future bookings. If you haven’t made a free account yet, use my referral link to get $30 off a hotel!

Hostel World is another website I use to find hostels to stay in, which tend to be cheaper than hotels or airbnbs. Hostels are a great way to meet people when you’re solo traveling, and you can typically choose between staying in a shared dorm or a private room.

Worldpackers is great for finding volunteer opportunities all over the world. There’s a wide range of opportunities ranging from hostels, farms, tour guides, content creation, and more. Volunteer opportunities usually offer free housing in exchange for work. Sometimes other benefits which may be included are free food, guided tours, laundry, sporting equipment, and more. I paid $61.44 for a 16-month membership. I’m currently at my first Worldpackers volunteering experience at a hostel called Nomadic Surf Camp in Costa Rica where I help with renting out surf boards and checking in guests. The work is easy, and I’ve made friends from all over the world during my two weeks here.

I make extra money by selling things I don’t want anymore on Depop and Mercari. I’ve sold lots of clothes I no longer wear on Depop and miscellaneous things such as photography equipment or decorations on Mercari. Click here to use my referral link to sign up for Mercari, and we can both make some extra money after you make $100 selling or buy something for the first time. Use code: FMAAAA when signing up.

I have a Marcus High Yield Savings account which allows me to make some extra money each month just for having money sitting in their account. Click here to use my referral link and receive a cash bonus!

I typically use Google Flights to see prices of flights, and I always make sure to add my airline membership number when buying flights so I can get extra reward points with those airlines. Most airlines have free memberships.

Please feel free to reach out by sending me a message on Instagram if you have any questions!

Leave a comment